Revenue cycle optimization is more than just efficient billing – it's a comprehensive approach to managing every aspect of your practice's financial operations, from patient scheduling to final payment collection. In today's competitive healthcare environment, practices that optimize their revenue cycle gain significant advantages in profitability, cash flow, and operational efficiency.

At JKB Medical, we've helped numerous practices transform their revenue cycle performance through systematic optimization strategies. This comprehensive guide outlines the key areas where practices can achieve meaningful improvements and the specific tactics that deliver the best results.

Understanding the Complete Revenue Cycle

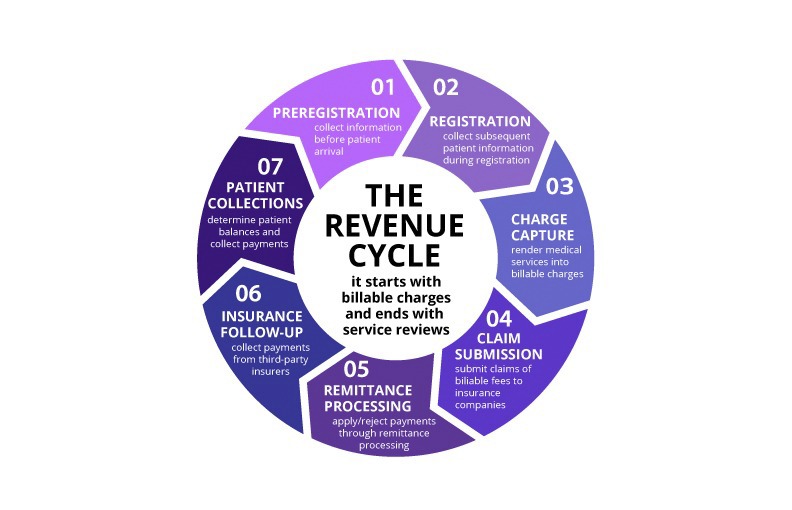

Before diving into optimization strategies, it's essential to understand that the revenue cycle encompasses much more than just billing and collections. The cycle begins when a patient schedules an appointment and continues through service delivery, claim submission, payment processing, and final account resolution.

Each stage of the revenue cycle presents opportunities for optimization, but also potential bottlenecks that can impact overall performance. Successful optimization requires a holistic view that considers how improvements in one area affect other parts of the cycle.

The key stages of the revenue cycle include patient access and scheduling, insurance verification, service delivery and documentation, coding and charge capture, claim submission, payment posting, denial management, and patient collections. Each stage must work seamlessly with the others to achieve optimal results.

Front-End Optimization: Setting the Foundation

The most impactful revenue cycle improvements often occur at the front end of the process, before services are even delivered. Front-end optimization focuses on ensuring that all necessary information is collected accurately and that potential issues are identified and resolved early.

Patient access optimization begins with streamlined scheduling processes that capture complete and accurate demographic and insurance information. Implementing online scheduling tools can improve efficiency while reducing staff workload, but these tools must be configured to collect all necessary information for billing purposes.

Insurance verification should occur for every patient, ideally at the time of scheduling or within 24 hours of the appointment. This process should verify coverage, benefits, copayment amounts, deductible information, and any prior authorization requirements. Real-time eligibility verification tools can automate much of this process while providing immediate feedback to staff.

Financial counseling and patient education about costs, payment options, and financial responsibilities should occur before service delivery whenever possible. This proactive approach improves patient satisfaction while increasing the likelihood of collecting patient payments.

Charge Capture and Coding Excellence

Accurate and timely charge capture is critical for revenue cycle success, yet many practices struggle with missed charges, coding errors, and delays in charge entry. Optimizing this area can have immediate and significant impact on revenue.

Implementing systematic charge capture processes ensures that all billable services are identified and coded correctly. This includes establishing clear procedures for documenting services, regular audits to identify missed charges, and training for all clinical staff on the importance of complete documentation.

Coding accuracy is essential for clean claim submission and compliance. Regular training on coding updates, specialty-specific coding requirements, and documentation standards helps maintain high accuracy rates. Consider implementing coding review processes for complex cases or high-value services.

Charge lag – the time between service delivery and charge entry – should be minimized to improve cash flow. Establishing daily charge entry goals and monitoring performance against these targets helps identify and resolve bottlenecks quickly.

Claims Management and Submission Optimization

Clean claims submission is the cornerstone of efficient revenue cycle management. Claims that are submitted correctly the first time are paid faster and require less administrative effort to manage.

Comprehensive claim scrubbing processes should be implemented to identify and correct errors before submission. This includes verification of patient demographics, insurance information, procedure and diagnosis codes, modifier usage, and compliance with payer-specific requirements.

Electronic claim submission should be used whenever possible, as it reduces processing time and provides faster feedback on claim status. Ensure that your practice management system is configured correctly for each payer and that staff are trained on electronic submission procedures.

Claim tracking and follow-up processes should be established to monitor claim status and identify issues quickly. Many practice management systems provide automated claim tracking features that can alert staff to potential problems before they become denials.

Payment Processing and Posting Optimization

Efficient payment processing and posting are essential for maintaining accurate account balances and providing clear financial reporting. Delays or errors in this area can create confusion and impact collection efforts.

Electronic Remittance Advice (ERA) processing should be implemented to automate payment posting for the majority of claims. This reduces manual effort while improving accuracy and speed of posting. Staff should be trained on handling exceptions and complex adjustments that require manual intervention.

Patient payment processing should be streamlined to make it easy for patients to pay their balances. This includes offering multiple payment options, implementing online payment portals, and establishing clear payment policies and procedures.

Payment posting accuracy is critical for maintaining correct account balances. Regular reconciliation processes should be established to ensure that all payments are posted correctly and that any discrepancies are identified and resolved quickly.

Denial Management and Appeals

Even with optimized front-end processes and clean claims submission, some denials are inevitable. Effective denial management can recover significant revenue while providing valuable feedback for process improvement.

Denial analysis should be conducted regularly to identify patterns and root causes. This analysis should categorize denials by type, payer, and reason to help prioritize improvement efforts. Common denial categories include eligibility issues, coding errors, documentation problems, and authorization failures.

Appeals processes should be systematic and timely. Establish clear procedures for handling each type of denial, including specific timelines for appeals and rework. Train staff on appeals procedures and ensure that adequate documentation is available to support appeals.

Denial prevention measures should be implemented based on analysis results. This might include enhanced staff training, improved documentation templates, or changes to verification procedures. The goal is to reduce future denials by addressing root causes.

Technology and Automation

Technology plays an increasingly important role in revenue cycle optimization. From automated eligibility verification to AI-powered coding assistance, technology can improve efficiency, accuracy, and staff productivity.

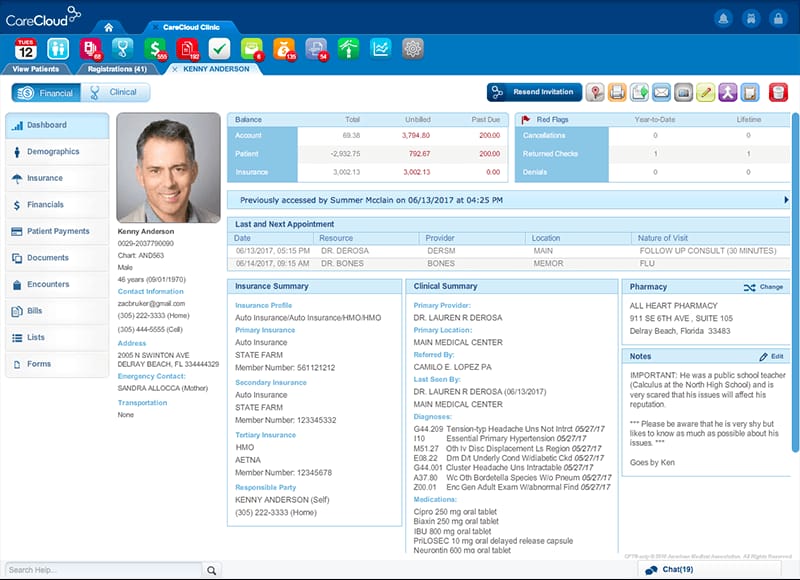

Practice management system optimization ensures that your technology is configured correctly and being used to its full potential. This includes setting up automated workflows, customizing reports, and training staff on advanced features.

Integration between systems can eliminate duplicate data entry and reduce errors. Consider integrating your practice management system with other tools such as patient portals, payment processors, and communication platforms.

Reporting and analytics tools provide the data needed to monitor performance and identify improvement opportunities. Establish regular reporting schedules and train staff on interpreting and acting on report data.

Performance Monitoring and Continuous Improvement

Revenue cycle optimization is an ongoing process that requires regular monitoring and adjustment. Establishing key performance indicators (KPIs) and regular review processes helps ensure that improvements are sustained over time.

Key metrics to monitor include days in accounts receivable, clean claim rate, denial rate, collection rate, and charge lag. These metrics should be tracked regularly and compared to industry benchmarks and historical performance.

Regular staff training and education help maintain high performance levels and ensure that staff stay current with changing requirements. This includes training on new procedures, coding updates, and technology enhancements.

Process improvement initiatives should be ongoing, with regular assessment of current processes and identification of improvement opportunities. Consider implementing formal quality improvement programs that engage staff in identifying and implementing improvements.

The Role of Outsourcing in Revenue Cycle Optimization

For many practices, partnering with a specialized revenue cycle management company can provide access to expertise, technology, and resources that would be difficult to develop internally. Outsourcing can be particularly beneficial for smaller practices or those with limited administrative resources.

When evaluating outsourcing options, consider factors such as the vendor's experience with your practice type, their technology capabilities, reporting and communication processes, and their approach to continuous improvement. The right partner should function as an extension of your team, providing expertise and support while maintaining focus on your practice's specific needs.

Measuring Success

Successful revenue cycle optimization should result in measurable improvements in key performance indicators. These might include reduced days in accounts receivable, increased collection rates, lower denial rates, and improved cash flow predictability.

However, success should also be measured in terms of reduced administrative burden on clinical staff, improved patient satisfaction with billing processes, and enhanced compliance with regulatory requirements. The best optimization strategies deliver benefits across multiple dimensions of practice performance.

Ready to Optimize Your Revenue Cycle?

JKB Medical specializes in comprehensive revenue cycle optimization for healthcare practices. Our team can help you identify improvement opportunities and implement strategies that deliver measurable results.

Schedule a Free Assessment